Understanding Business Valuation Methods for Buyers

When it comes to purchasing a business, having the right business valuation methods for buyers is essential. Valuation is not just about determining a price; it's about understanding the true worth of an enterprise, how it fits into your investment strategy, and what risks might be involved. In this comprehensive article, we will explore various valuation methods, their advantages, and how buyers can effectively use them to make informed decisions.

The Importance of Business Valuation

Valuing a business is a critical step in the acquisition process. The price tag is often a negotiation point, but the underlying value reflects a company's potential risks and rewards. Here are key reasons why business valuation is important:

- Informed Decision Making: A thorough valuation provides insights into the company's fundamentals, allowing buyers to assess the potential for growth and profitability.

- Negotiation Leverage: Understanding the value gives buyers the power to negotiate effectively, ensuring they do not overpay for the business.

- Investment Strategy Alignment: Valuation helps determine if the potential acquisition aligns with the buyer's investment goals and strategy.

- Risk Assessment: Knowing the business's worth helps in assessing the inherent risks associated with the investment.

Key Business Valuation Methods

Below, we delve deeper into the most commonly used business valuation methods for buyers. Each method has its merits depending on the context, industry, and nature of the business being evaluated.

1. Asset-Based Valuation Method

The asset-based valuation method calculates the value of a business by assessing its total assets and subtracting liabilities. This approach is beneficial for companies with significant tangible assets or investments.

- Types of Asset-Based Approaches:

- Book Value: This method looks at the company's balance sheet for a snapshot of assets and liabilities.

- Liquidation Value: This estimates the net cash that would be received if the assets were liquidated.

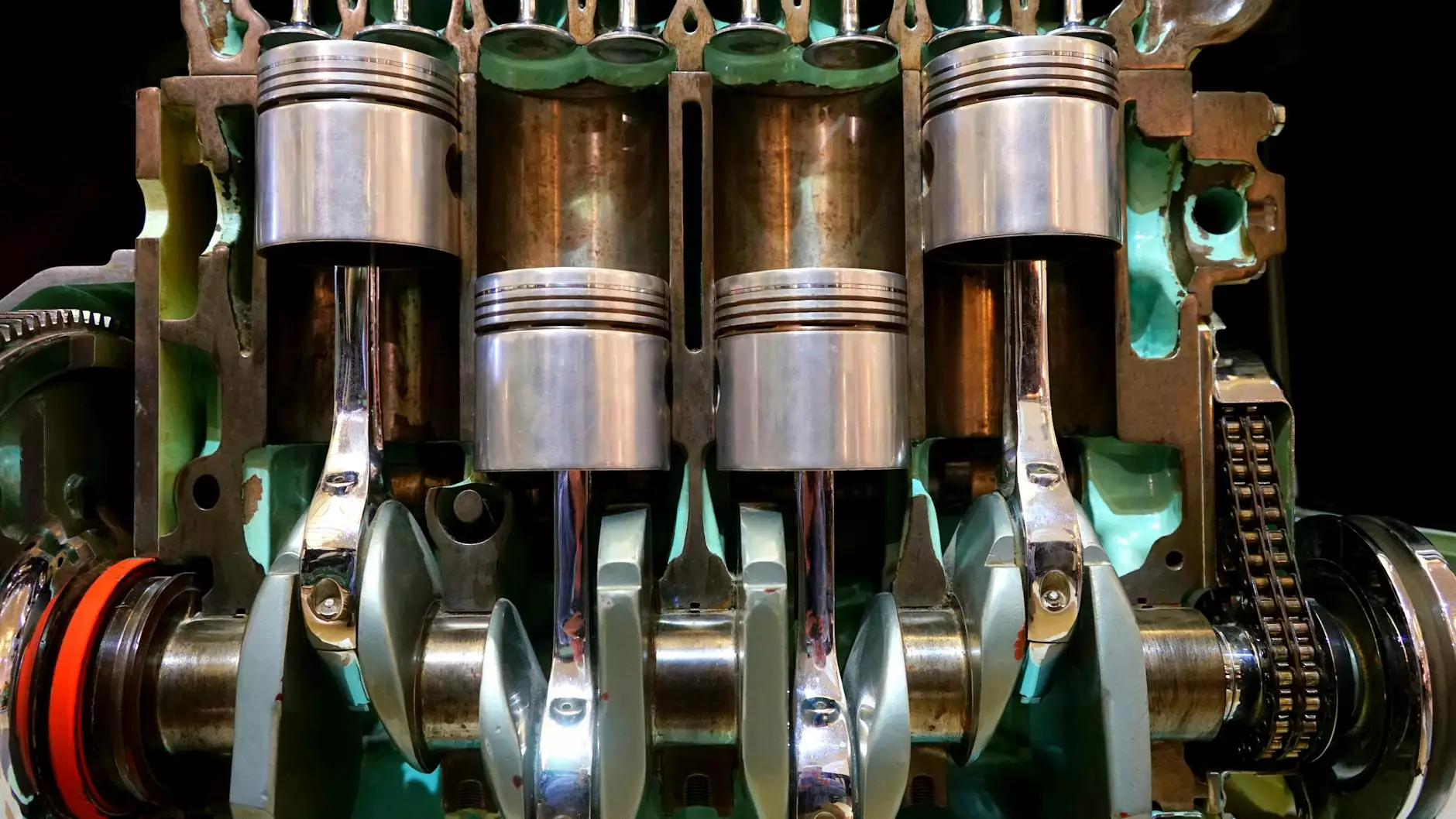

The asset-based method is particularly useful in certain industries such as real estate or manufacturing, where physical assets play a central role in the business's value.

2. Income Approach to Valuation

The income approach focuses on the business's ability to generate earnings and cash flow over time. This method is widely favored for service-oriented businesses or those with predictable revenue streams.

- Discounted Cash Flow (DCF): This technique estimates the future cash flows the business will generate and discounts them to present value using an appropriate discount rate.

- Capitalization of Earnings: This method takes a single measure of earnings and divides it by a capitalization rate to determine value. It’s crucial for mature and stable businesses.

The income approach is preferred when a business's earning potential is paramount, as it reflects both the current performance and future potential.

3. Market Value Method

The market value approach involves comparing the business to other similar businesses that have been sold recently. This method relies heavily on available market data and is particularly effective in active industries.

- Comparable Company Analysis (CCA): This involves analyzing the financial metrics of similar businesses to derive a fair market value.

- Precedent Transactions: This examines past transactions of similar companies to estimate a valuation based on actual sale prices.

The market value method is advantageous when a buyer wants to understand the valuation multiples prevalent in the industry and gain insight from the competitive landscape.

Choosing the Right Business Valuation Method

Selecting the appropriate business valuation methods for buyers involves considering several factors:

- The Type of Business: Different industries may favor specific valuation methods based on their unique characteristics.

- Available Data: Assess the quality and quantity of data available, especially when employing market or income approaches.

- Purpose of Valuation: Consider whether the objective is acquisition, investment analysis, or preparing for an eventual exit.

- Time Constraints: Some methods require extensive time and resources to evaluate effectively, while others might be quicker and simpler.

Common Pitfalls in Business Valuation

Buyers must be cautious about common pitfalls that can arise during the valuation process:

- Overreliance on a Single Method: Using only one valuation method can yield skewed results. It’s recommended to apply multiple approaches for a comprehensive view.

- Ignoring Market Conditions: Not considering the current economic climate can lead to unrealistic valuations.

- Focusing Solely on Financial Metrics: Qualitative factors such as management quality and market position are equally important.

- Underestimating Risk: Appropriate risk assessment is crucial in valuation, particularly regarding industry-specific challenges.

Conclusion

Understanding and applying the right business valuation methods for buyers is a fundamental aspect of making sound investment decisions. Whether taking an asset-based, income, or market approach, ensuring a comprehensive analysis can equip buyers with the insights needed to negotiate and structure a favorable deal.

At OpenFair, we pride ourselves on providing expert business consulting services that guide buyers through the complexities of valuation and negotiation processes, ensuring they capitalize on the true potential of their investments.

Invest wisely!